Pass-Through Entity Annual Withholding Return - For taxable years beginning on or after January 1 2020 a pass-through entity that has paid withholding on behalf of a nonresident owner or has been withheld upon must use Form 592-PTE Pass-Through Entity Annual Withholding Return to report the total withholding. Single Married filing jointly.

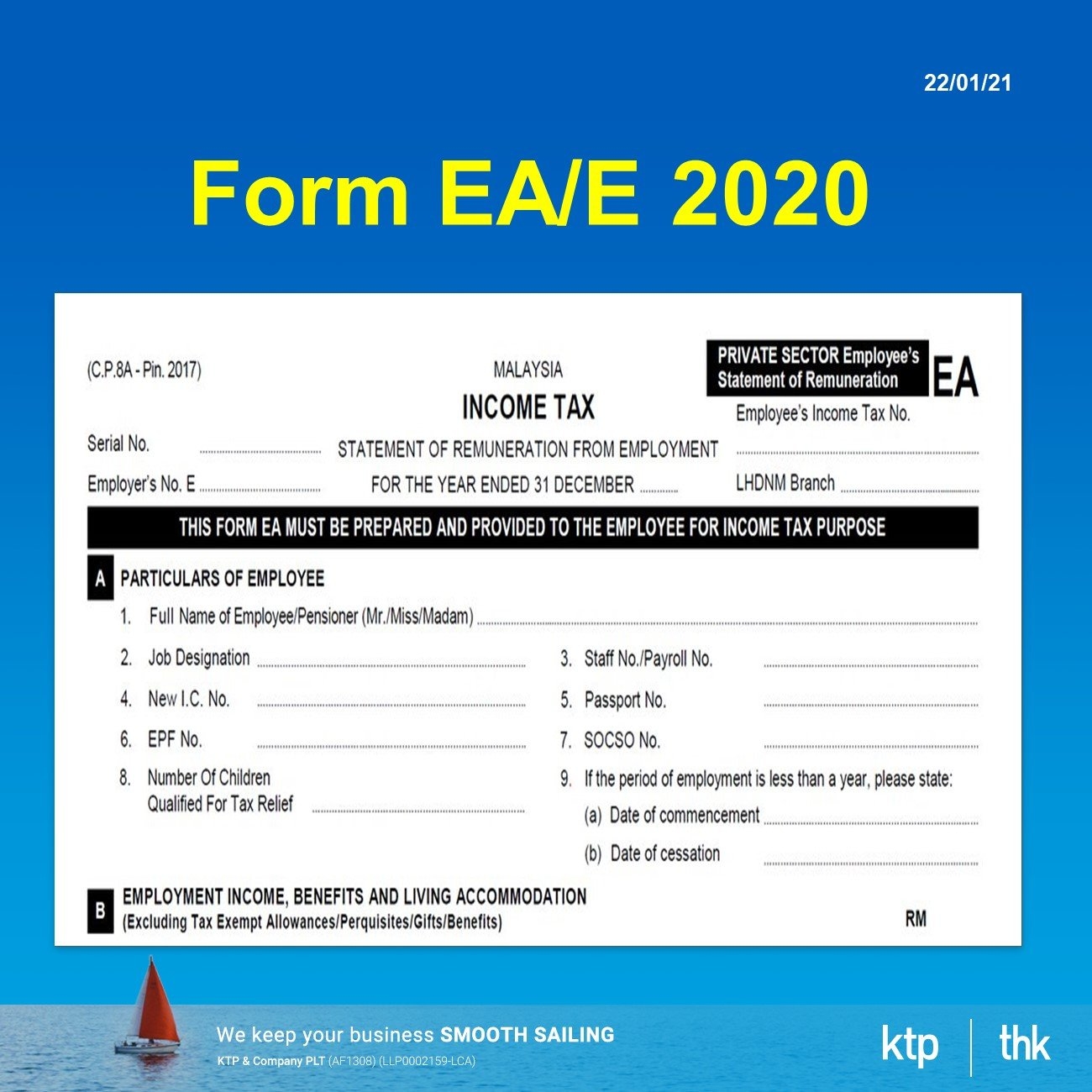

When Can I Submit Form E 2020 Jan 22 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Business Income Tax Malaysia Deadlines For 2021

File Form B For International Trade Jpg Wikimedia Commons

Form 5500-SF 2020 Page.

Form b 2020. Extension of due date for furnishing statements. Federal adjusted gross income from your federal Form 1040 or 1040-SR Line 11. Be sure to enclose any forms or.

Base Income Step 3. Individual Income Tax Return 2020 Department of the TreasuryInternal Revenue Service 99 OMB No. 2020 FORM 1 PAGE 3.

Add Lines 1 through 3. 2020 MARYLAND STATE DEPARTMENT OF ASSESSMENTS AND TAXATION Form 1 Taxpayer Services - Charter Division PO. January 1 2015 and to the California Revenue and Taxation Code RTC.

For Paperwork Reduction Act Notice see the Instructions for Form 5500-SF. References in these instructions are to the Internal Revenue Code IRC as of. Married filing separately MFS Head of.

Relief for failure to furnish. Form RP-425-B821 Application for Basic STAR Exemption for the 2020-2021 School Year Revised 821 Created Date. Pass-Through Entity Annual Withholding.

Resident and Nonresident Withholding Tax Statement. See Notice 2020-76 and Extension of Time To Furnish Statement to Recipients later. IRS Use OnlyDo not write or staple in this space.

The due date for furnishing Form 1095-B to individuals is extended from January 31 2021 to March 2 2021. 2020 Instructions for Form 592-B. Type of Business by Department.

For more information get Form 592-PTE. Ederally tax-exempt interest and dividend income from your federal Form 1040 or 1040-SR Line 2aF. Entered on Form 1095-B line 8 to identify an individual coverage HRA.

Check only one box. Form 5500-SF 2020 v200204. TAXPAYERS FIRST NAME MI.

LAST NAME TAXPAYERS SOCIAL SECURITY NUMBER MASSACHUSETTS WITHHOLDING PAYMENTS AND REFUNDABLE CREDITS 38 Massachusetts income tax withheld. Box 17052 BALTIMORE MARYLAND 21297-1052. ID Prefix Filing Fee Type of Business Check one business type below Dept.

Form 5500 and lines 11a and b below If this is a defined contribution pension plan leave line 11 blank and complete line 12. Check one business type be low Dept.

1

How To File Schedule C Form 1040 Bench Accounting

Schedule B Fill Out And Sign Printable Pdf Template Signnow

2

2

Form B Register Services Ccng Chartered Accountants

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

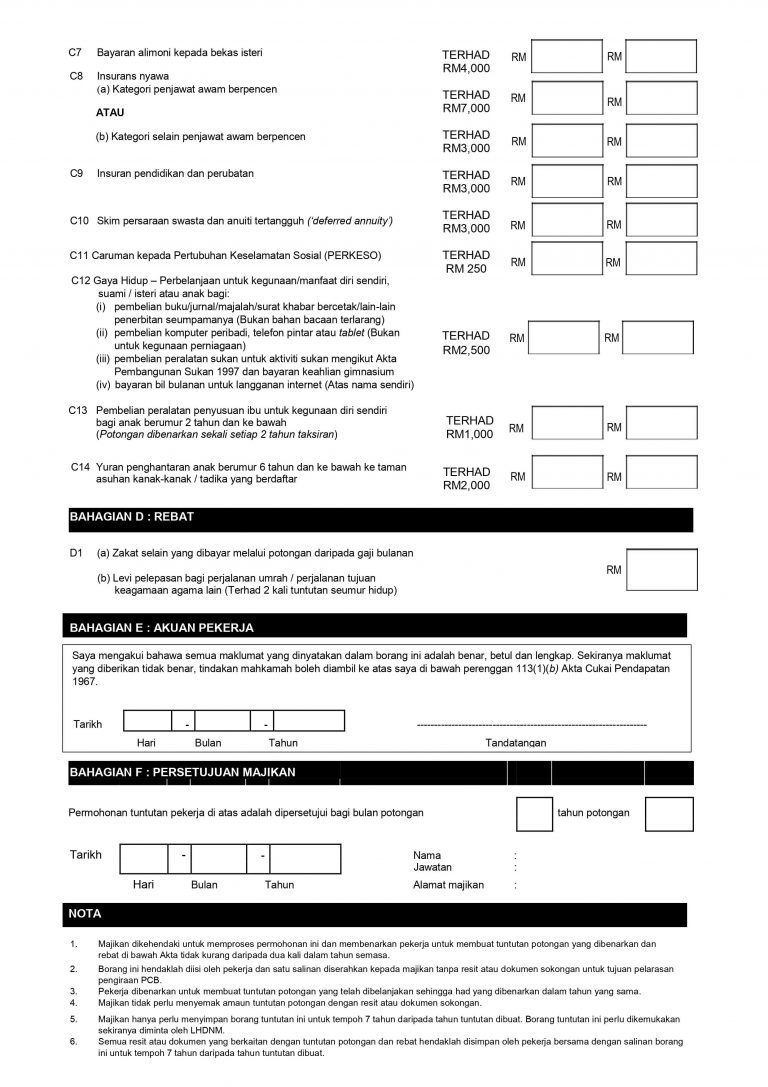

Tp1 Form Tp2 Form Tp3 Form Malaysia Free Download Sql Payroll Hq